How much do boomerang kids REALLY cost?

Having two active and hungry adult sons at home is not cheap.

Leeann Gill spends almost $300 a week on food – about double what she’d spend if it was just her and husband Ben. Gill estimates the extra food, bills and incidentals set them back about $10,000 a year.

Financially it’s definitely harder when you’ve got … adult children living at home

Andrew and Patrick also have girlfriends who visit and stay over, meaning up to six mouths to feed.

“Financially it’s definitely harder when you’ve got … adult children living at home,” Gill said.

But the Gills have the perfect solution to get their boys to leave home – they’re going to sell it. Leeann, 54, and Ben, 60, plan to downsize and give Andrew, 26, and Patrick, 23, part of the profit to put towards a home deposit.

Who wants to rent a share house when you can live with mum and dad? Source: ShutterStock

But there is a catch

Andrew, an apprentice groundsman, and Patrick, a primary school teacher, must save 25 per cent of their income for six months and commit that to the deposit as well.

Both also pay a percentage of their income as board and buy their own clothes.

Gill said this helped them contribute to their keep and develop a sense of responsibility. “In life you have to pay your bills before you go and buy a slab of beer,” is her simple philosophy.

So far the plan has worked a treat. Leeann, a nurse, and Ben, a printer, plan to downsize in the next year or so in the same part of Melbourne’s eastern suburbs they now live. But for now they enjoy living with their sons, who do their own washing and ironing and can cook.

The Gill boys are among the growing number of Australian adults living with their parents, dubbed KIPPERS by some – Kids in Parents’ Pockets Eroding Retirement Savings. Patrick is also part of the “Boomerang Generation” that leaves and then returns, often several times.

‘Boomerang’ kids

A 2009 Australian Bureau of Statistics report found that 31 per cent of people aged 20–34 had left home and returned.

“Having left home for the first time, the probability that someone would return home at least once before turning 35 was almost one in two (46 per cent),” the report found.

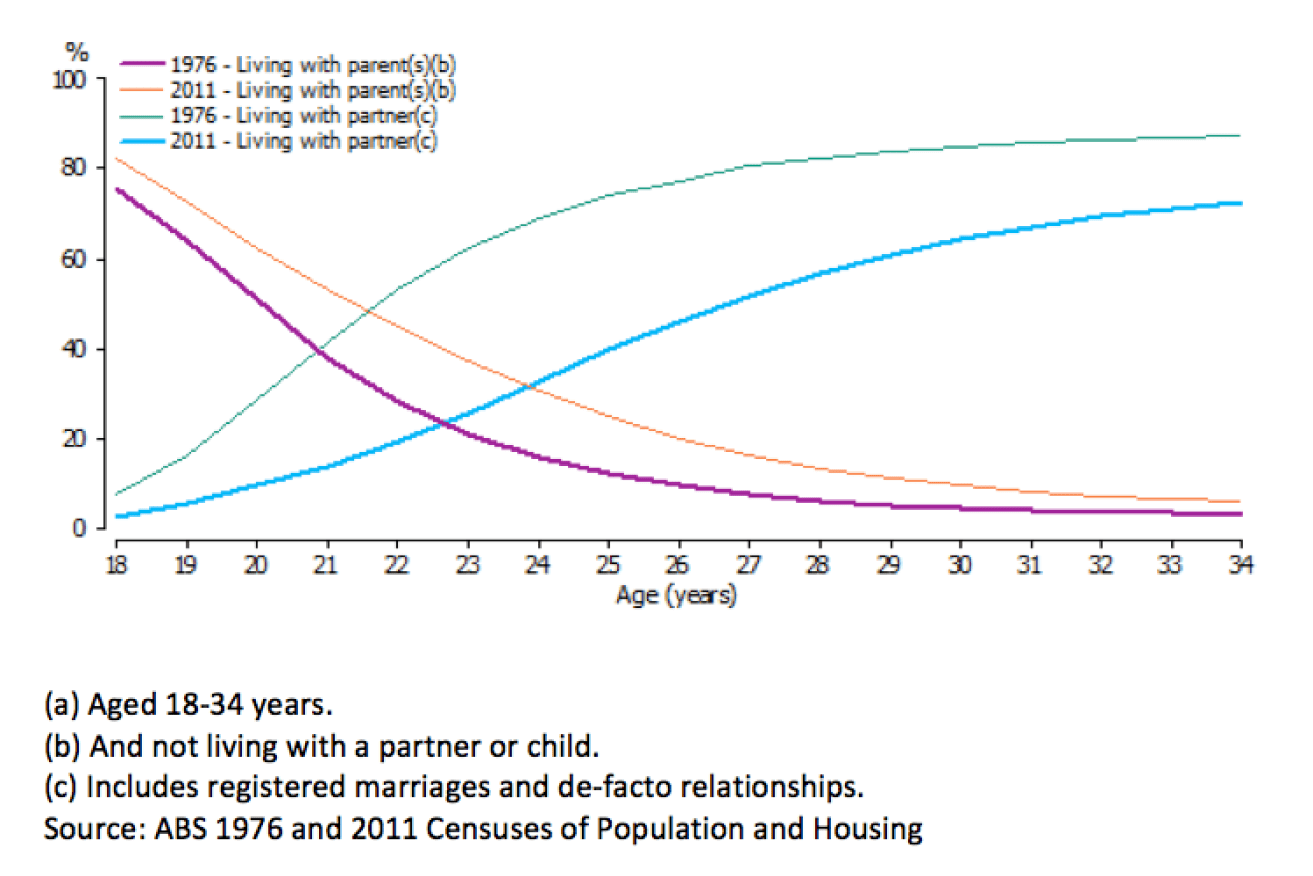

A 2013 ABS report, Young Adults Then and Now, also found that those aged 18-34 much more likely to live at home with their parents than in 1976 – up from two in ten to almost three in ten.

In 1976, about 65 per cent of young adults lived with a partner and 74 per cent of them had children. In 2011, about 42 per cent lived with a partner and of these only 52 per cent had children.

KPMG demographer Bernard Salt said KIPPERS were a growing phenomenon and as a rule baby boomer parents loved having them at home as it made them feel needed and valued. But he said parents needed to focus on their financial situation as well.

Salt said 20-somethings faced HECS debt and higher property prices, but parents should also teach them to pay their own way. Otherwise their retirement funds could end up substantially eroded.

“That (rising life costs) can also be used as a convenient excuse not to focus on financial independence,” he says. “It’s almost like Gen Y is getting their inheritance up front.”

Taking responsibility

The Gills have taught their boys financial responsibility. Andrew has always been at home but Patrick spent four years in Ballarat at university, on campus and in a share house, working at Coles to earn his keep.

Both grew up doing their own ironing and sometimes cooking as Gill has coached Australian Rules football for many years and is often out late at training. Ben has also worked afternoon shifts.

Gill now works part-time as a nurse and is Football Development Manager at Rowville Football Club. Andrew and Patrick both coach junior teams, helped by Mum, who also coaches the Victorian schoolgirls’ under-16 football team.

It’s not just to sponge off their parents – they just can’t afford it

Gill knows downsizing will leave her and Ben with less money for retirement, but they’ll still be happy and hope it will encourage their boys to enjoy the independence they had. She moved out of home at 17 to study nursing.

“We’ve got a double storey house and it’s just too big,” she said. “We said to the boys, ‘We’d rather help you now while we’re still alive’.”

Gill also understands how hard it is for young adults to make ends meet outside home, with HECS fees and the rising cost of housing and living. “I can see why kids are actually staying at home,” she said. “It’s not just to sponge off their parents – they just can’t afford it.”