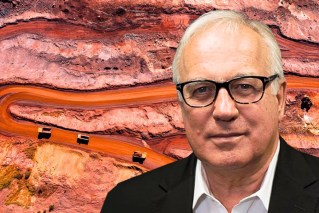

The million-dollar question Westpac CEO Brian Hartzer won’t answer

Mr Hartzer is the last of the bank bosses to front the economics committee.

Westpac CEO Brian Hartzer has refused to disclose to a parliamentary committee how many of his bank’s employees are paid more than $1 million.

Mr Hartzer told the economics committee on Wednesday his bank would not be disclosing that figure because the issue is too “sensitive” and “emotive”.

“Well, obviously, pay is a sensitive issue for individuals involved and the community,” the bank boss replied to Labor MP Matt Keogh.

“It’s a sensitive issue and it’s one that’s been looked at by many governance bodies and different elements of government over time. Where we’ve landed is a standard set by the Corporations Act and in conjunction with …”

Mr Keogh cut in, demanding clarity.

The Westpac boss said he was prepared to comply with whatever rules the government sets, but said again it was a sensitive issue.

“When you have a job like mine, your pay is fully disclosed. With that comes a lot of attention, and that’s as it should be. But the topic is clearly one of a lot of attention, and therefore we try to balance that off with meeting the obligations that are set for us.”

Mr Hartzer was the last of the big four bank bosses to refuse to make public the number of executives earning above $1 million.

Executive pay has been a big issue in recent months, after revelations that Australia Post CEO Ahmed Fahour was paid $5.6 million seemed to trigger his surprise resignation.

Ardent Leisure CEO Deborah Thomas also yielded to public pressure by donating $167,500 to charity after a tragedy at the Dreamworld theme park owned by the company.

To make a point on whether bank bosses deserve their huge salary packages, Mr Keogh probed why Westpac pays its CEO about $6.7 million when the Commonwealth Bank pays its CEO Ian Narev almost double: $12.3 million.

“Is Ian twice as good as you? Or are you just a bargain for Westpac?” the Labor MP asked.

“I think I’m very good value,” Mr Hartzer replied, to laughter in the room.

Customers and shareholders may not find the matter quite so funny. For as Mr Keogh noted, Westpac is only a “little bit” smaller than its competitor. CBA has a market capitalisation (total shares multiplied by current price) of about $143 billion, compared to Westpac’s $116 billion.

So why does Ian Narev earn double? And are customers and shareholders getting good value? The victims of the bank’s CommInsure and financial advice scandals might have an opinion on that.

What Mr Keogh may have been hinting at with his original question on salary reporting is that Labor will push for tougher disclosure rules.

Since January 2017, US companies are required to report how many times larger their CEO’s pay packet is than the company’s median worker. The UK enacted a similar scheme in October 2013.

Treasurer Scott Morrison has refused to copy these reporting schemes.

Australia already has a ‘two strikes’ rule, introduced in 2011, which allows investors to trigger a board spill if 25 per cent or more of a company’s shares vote against two consecutive remuneration reports.

Late last year, CBA became the first big-four bank to suffer ‘strike one’.