Michael Pascoe: Graphs tell the story the RBA doesn’t – tax cuts boosting interest rates

Two graphs suggests the RBA board hadn’t considered the stage-three tax cuts’ impact on inflation, Michael Pascoe writes. Photo: TND/AAP

A picture may be worth 1000 words, but a Reserve Bank graph in this month’s Statement on Monetary Policy is worth more than the 4000 words in the RBA board minutes published on Tuesday.

The graph subtly says what the RBA minutes and the November SoMP dare not: The stage-three tax cuts next year are indeed inflationary, playing a role in interest rates staying higher for longer – and thus we have higher interest rates.

The graph featuring the tax cut impact when the SoMP and RBA board keep schtum raises some interesting possibilities.

Has the Treasurer/Treasury so cowered the bank it won’t go where it might politically offend?

Or had the bank not believed until this month that the government would be so economically irresponsible as to go ahead and pull the pin on the grenade Scott Morrison had implanted in Anthony Albanese’s small target, Liberal-lite election campaign?

The differences between the August and November SoMP CPI forecast graphs are subtle, but the tax cut bounce is definitely there in the latest effort.

It would be a surprise if it wasn’t. If injecting an extra $21 billion into the economy next financial year isn’t stimulatory, I don’t know what is.

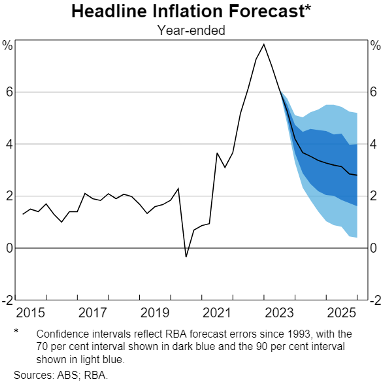

In August, this was the RBA’s CPI forecast – note that while the pace of decline in inflation was expected to slow next year, it was still shown as smoothly heading south.

RBA CPI forecast August 4

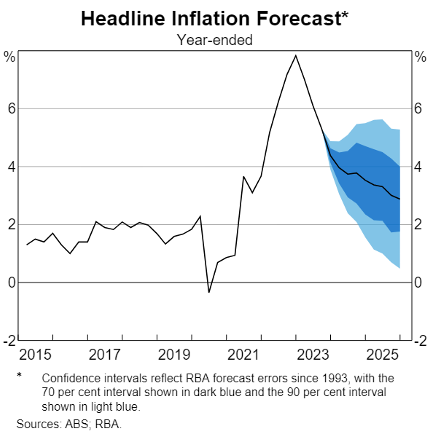

But something happened to the RBA’s graph paper people between August and November – they remembered the stage-three tax cuts start on July 1.

RBA CPI forecast November 10

Instead of the smooth slide, the bank’s central case now is for inflation to have a bounce in the second half of 2024 as the tax cuts kick in, delaying the hoped-for eventual return to the RBA’s target zone.

Funny thing: There is no mention of it in the minutes of this month’s board meeting or in the economic outlook section of the SoMP.

The board is supposed to pore over the bank’s revised forecasts for the November meeting, but the minutes would lead us to believe they didn’t notice/think of/discuss the tax cut impact on inflation when they decided to increase interest rates explicitly because inflation isn’t going to fall fast enough.

Are the board members and the RBA mandarins that incompetent?

I don’t think so, or I certainly hope not. More likely, they’ve been beaten down by Jim Chalmers’ Treasury into not mentioning the embarrassment of the government saying it’s sticking with unnecessary tax cuts fuelling inflation when the “cost of living crisis” is all the political rage.

The bank also treads softly-softly in acknowledging that scraping the low-middle income tax offset (LMITO) is hurting people in the aforementioned low-middle income bracket.

The only time tax is mentioned in the economic outlook is:

“The relatively soft outlook for GDP growth in the near term reflects subdued growth in consumption by Australian residents as higher interest rates, cost-of-living pressures and higher tax payable weigh on real disposable income growth.”

Well, there’s actually no real disposable income growth – it’s still negative, as another RBA graph shows:

The bank thinks/hopes real disposable income won’t start growing again until late next year.

I’d guess some people – those on higher incomes getting fat tax cuts – will disproportionately feature on the positive side of the disposable income ledger.

The RBA board was equally shy about the extra thousand dollars or so people down the income scale are paying the government without LMITO. The word “tax” occurs just once in the minutes:

“Real household disposable income was expected to decline over 2023, reflecting the combined effects of high inflation and the rise in interest rates and tax payable.”

Softly mention a tax policy reducing demand, reducing pressure for higher rates. Say nothing about a tax policy that will increase demand while inflation remains well above the target, increasing pressure for higher rates.

The Tale of Two Graphs suggests that the board hadn’t considered the stage-three tax cut impact on inflation. That’s a worry.

If “better communication” is supposed to be part of the new governor’s remit in the wake of the Treasury’s review, recognising that tax cut impact helping push the bank off the pause button and onto the rate hike lever requires explanation.

The politics of the tax cuts and the hay the opposition is making out of the interest rate increases is risible. The asinine calls for the Prime Minister to stop trying to repair the Coalition’s diplomatic damage and concentrate on “cost of living” would be laughable if the polls weren’t indicating some people were taking them seriously.

A political party worthy of being taken seriously wouldn’t be adding an extra $21 billion to demand pressures next financial year when the iniquitous and inequitable blunt instrument of monetary policy is bludgeoning one section of society.

Of course, it is Peter Dutton’s great hope that Labor will do the right thing by the nation and postpone, scrap or reduce the stage-three cuts. Cue the “broken promise” and “liar” slogans.

Mr Dutton shouldn’t hope too much. There’s no sign of Mr Albanese showing the leadership necessary to make such a hard political decision for the greater good.

Don Watson’s fine post-mortem in The Monthly of the Voice referendum found plenty of blame to go around – John Howard’s fearmongering shadow, Mr Dutton’s lack of honour – but also Mr Albanese’s lack of leadership in going ahead with the referendum when it wasn’t bipartisan and therefore sure to fail:

“What he needed was the courage to say to (the Indigenous Voice leaders)– admirable as they are, formidable as they are – as prime minister, as a politician, as someone who is paid to read the political signs, to lead: I can’t go on with this knowing I will be leading you over a cliff. Courage is essential, but defeat in this is unthinkable. We must find another way.

“No form of words would have saved him from their outrage, and years later there would still be people saying the referendum could have been won if only Albanese hadn’t squibbed it. It goes with the job, like the victories, and it’s a lot better than being told what the country has now told Aboriginal kids. Or what it told the people who have given so much of their lives to the creation of something better and who gave their all to this. It is not on them that responsibility should fall.”

The government is already busy preparing the 2024-25 budget, the one that is supposed to include the stage-three cuts. There’s another leadership decision in the offing.

Just don’t expect the RBA to call out the government on it, unless you can find the person who draws the graphs.