Treasurer makes case for no-frills budget

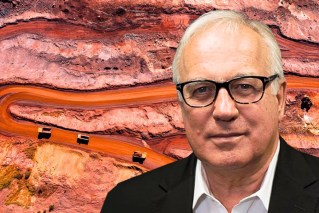

The troubling state of the global economy prompts a warning from treasurer Jim Chalmers as he prepares to deliver the Labor government's first budget. Photo: AAP

The treasurer has doubled down on his commitment to deliver a sensible budget in light of troubling global economic conditions and the fallout from COVID spending.

Treasurer Jim Chalmers said Australia was in a better position economically than many of its international peers – thanks in part to the unexpected boost to government coffers from high commodity prices.

“Welcome short-term improvements in revenue raised from our resources in the near term go nowhere near to properly paying for the five fastest growing areas of spending in the budget: health care; the National Disability Insurance Scheme; aged care; defence; and the rising cost of interest we pay to service $1 trillion of debt,” Dr Chalmers said.

His remarks follow a 0.75 percentage point rate hike by the US Federal Reserve on Thursday morning – an aggressive strategy the central bank’s chair admits will put the world’s largest economy at risk of recession.

With looming economic challenges domestically and abroad, Dr Chalmers said said the October budget would contain responsible cost of living relief that would not make inflation worse.

“It means trying to deal with the issues in our clogged supply chains that are forcing up inflation, and providing relief from rising prices that delivers for the economy and doesn’t force the RBA’s hand on further rate rises,” he said in an opinion article for The Australian.

Dr Chalmers set the stage for reforming how the government manages its finances, which could include tax reform and reprioritised spending.

“It’s the beginning, not the end, of a big national conversation about our economic challenges, the structural position of the budget going forward, and the kinds of choices we need to make as a country in the future about what our priorities are, what’s affordable and what’s fair,” he said.

While Australia is dealing with soaring inflation, the rising cost of living is yet to stymie spending, with sales up 27.4 per cent on pre-pandemic levels.

The Mastercard spending data showed discretionary spending recovered strongly from the impact of COVID-19 last year, with jewellery sales up 107 per cent in 12 months and apparel up by 83 per cent.

Australian Retailers Association head Paul Zahra said that level of growth wasn’t surprising given the two largest states were in lockdown this time last year.

However, he warned a slowdown in spending was imminent.

“While consumer spending is strong for now, the concern is that we haven’t seen the full impact of the interest rate hikes hit household budgets,” Mr Zahra said.

He said small businesses were harder hit by inflationary pressures as they struggled to meet the rising costs of fuel, energy and rent.

– AAP