Big banks cut out of tax package, but Hanson digs in

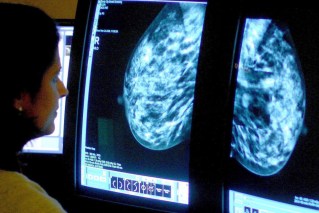

Pauline Hanson says she won't back the government's tax cut plan because she has not seen the draft legislation Photo: AAP

Australia’s big four banks would be carved out of the government’s corporate tax cut package under a proposal designed to woo cross-bench support.

Finance Minister Mathias Cormann on Tuesday secured the Senate’s support to debate the plan to exclude Commonwealth Bank, ANZ, NAB and Westpac.

He has made the offer to key cross-benchers, including One Nation leader Pauline Hanson and her colleague Peter Georgiou.

But the changes don’t extend to capping the tax rate being cut from 30 to 25 per cent for businesses with $500 million – as suggested by independent senator Derryn Hinch.

While Senator Hinch is urging the government to back his threshold, he will vote in favour of carving out the banks.

No draft legislation was ever received and I can confirm Senator Georgiou did not receive this alleged document either.

But Senator Hanson won’t support the compromise because One Nation wasn’t shown draft laws.

“In a parting comment by minister Cormann, he suggested carving out the banks to secure One Nation votes, to which I said my decision was firm,” Senator Hanson said in a statement.

“No draft legislation was ever received and I can confirm Senator Georgiou did not receive this alleged document either.”

The corporate tax cuts survived an initial Senate vote on Tuesday, allowing the government to try to amend the bill to exclude the big banks.

The move would make the overall tax plan $7.9 billion cheaper to 2027/28.

Senator Cormann called on Labor to support the changed tax plan.

“If it’s all about the big banks, well no doubt you will vote in favour of this amendment and you will then vote in favour of the legislation as a whole,” he said.

But Labor frontbencher Doug Cameron ruled out a compromise, urging the government to take its plan to the next federal election.

“This is not just about the banks. This is about an ideological obsession from this government that if you simply cut tax, jobs will be created,” Senator Cameron said.

Parliament has already agreed to deliver tax relief to companies with an annual turnover of up to $50 million, but the 25 per cent rate will be brought in gradually.

Labor estimates bringing forward tax cuts for businesses turning over under $50 million could cost the budget $1.8 billion over the next four years, and $6.5 billion in the medium term.

-AAP