‘Forgotten money’ protected

A surge in fraudulent applications on unclaimed bank deposits has forced the federal government to overhaul its rules for managing forgotten money.

In a move likely to benefit most bank customers, the government has extended the time that deposit accounts can be inactive before balances are transferred to the Australian Securities and Investment Commission (ASIC).

Under changes introduced by the Gillard government in 2012, money sitting in inactive bank accounts was classified “unclaimed” if there were no transactions after three years.

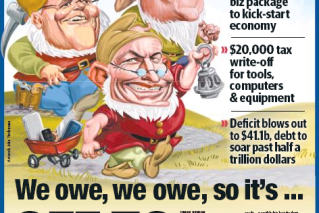

• Hockey’s ‘have a go’ budget

• A budget to save Joe’s bacon: Paul Bongiorno

• The strangest things in the budget

However, the Abbott government will extend the requirement for ASIC to wait at least seven years before it takes control of inactive accounts.

In the budget papers, the government also revealed changes to the way in which people will be able to track down lost deposits using ASIC’s information services.

ASIC will rein in the publication of lost account details and tighten access to account information through freedom of information requests.

That’s because there appears to have been a rise in the number fraud incidents relating to lost money claims.

The measures were intended to “address concerns around identity theft and to stop unscrupulous people preying on vulnerable Australians,” the budget said.

Consumer advocates welcomed the move to protect the information of holders of unclaimed accounts.

“It’s clearly important that measures are taken to improve the security of the information available through ASIC,” said CHOICE chief executive Alan Kirkland.

“We welcome these moves to protect the security of consumers’ personal information.”

The lost money rules will also be amended to ensure that children’s bank accounts are never transferred to the government.

These reforms will come at a considerable cost, with the government set to lose $158 million in revenue over the next four years.

Budget silent on new bank tax and super reform

The government did not reveal any details on how its new bank deposits tax would operate.

The new levy is expected to raise more than $500 million a year by taxing all banks and credit unions about 0.05 per cent of all deposits they hold.

There are around $1.6 trillion of deposits held at Australian institutions and most of the tax revenue is expected to be raised through the major banks – NAB, ANZ, Westpac and Commonwealth Bank.

Details of the new tax will be included in the government’s policy response to the recommendations of David Murray’s financial system inquiry.

That is expected to be released in June along with a raft of new measures on superannuation.

Changes to pensions

The Abbott Government appears to be adhering to its 2013 Election promise not to erode the superannuation entitlements of Australian retirees through the tax system.

While Mr Hockey did not comment on the likelihood of the government reducing lucrative tax breaks on self managed super funds in the future, he promised there would be “no new taxes on superannuation”.

“I want to reassure all Australian workers they can have confidence in their retirement plans,” he said.

Perhaps the most significant measure relating to superannuation announced in the budget was an amendment to the aged pension income test for retirees who are members of defined benefit super schemes.

The change aims to close eligibility loopholes that have allowed some retirees with relatively high super balances to claim part pensions.

The government is expecting to reap savings of almost $500 million over the next five years by tightening the income test for the pension.

This reform will affect many former public servants, university employees and private sector workers who retired on defined benefit super plans in the last twenty years.