Joe Hockey vs real Australians: how the budget affected them

Australians are busy calculating how they fared following the Abbott Government’s second federal budget announced Tuesday night.

After last year’s unpopular offering, the 2015 Federal Budget was definitely pitched to the people of Australia. Small business owners and parents with young children were the big winners across the nation.

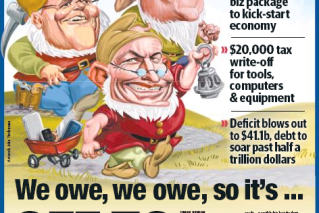

• Hockey delivers ‘have a go’ budget

• Paul Bongiorno: A budget to save Joe’s bacon

• Abbott’s first Labor budget

Mr Hockey described it as the budget to encourage Australians to “get out there and have a go”, calling it “responsible, measured and fair”.

The New Daily spoke with people from across the community.

Who: Kelly Favaloro, Ed Chamberlain

Who: Kelly Favaloro, Ed Chamberlain

Age: 30s

Location: Brisbane, QLD

Work: Young high-earning couple without kids (baby on the way)

Verdict: Better than expected

With a baby on the way, the pair were keen to find out about changes in paid parental leave and childcare policy.

Kelly said the new family package would remove her ability to negotiate her maternity leave with an employer, and would make it more difficult.

The Government is cutting access to the taxpayer funded, minimum wage paid parental leave scheme for those who can access maternity leave through work.

“I was in a position where I thought it was something I could negotiate with my employer,” Kelly said. “I thought I was meant to be one of Tony Abbott’s ‘women of calibre’?”

Kelly also welcomed the immunisation policy, saying “it was about time”

Ed said he was mostly concerned about Australia cutting aid from Indonesia, saying the poorer people would cop the brunt, and not the Indonesian government.

Who: Mary and Vass Paffas

Age: 60s

Where: Sydney, NSW

Work: Vass – retired, on age pension. Mary – works part-time, on carers pension

Verdict: Unaffected

The Government announced it would adjust the thresholds for assets tests on the pension.

This means 172,000 pensioners at the lower end of the pension would be better off, while 81,000 pensioners who currently claim the part pension would no longer be eligible.

Previously singles over the age of 65 with assets (excluding the family home) of less than $775,000 were able to claim the part pension, however the new limit would now be $550,000.

The Government confirmed these changes would replace efforts to change the way the pension was indexed, which would have negatively impacted pensioners more over the long term.

Mary said post-budget that they had escaped the budget unscathed this year. “As far as we can see, it won’t affect us,” she said.

Who: Kiandra Trickett

Age: 20

Where: Melbourne, VIC

Work: University student

Verdict: Sectors have been forgotten

Kiandra was concerned that higher education was overlooked in the 2015 Federal Budget.

She said it was no wonder the government stayed under the radar with university announcements, after the backlash and criticism they received after the first budget.

“While they have fixed lots of the controversies of last year’s budget, they have not really provided extra support to people who need it,” Kiandra said.

“A lot of university students are living away from home, or are international students, and they struggle massively. A lot of students live below the poverty line.

“I work for the student union and we have support for them, but there needs to be more.”

Kiandra said she wasn’t sure what the government’s tactic was for higher education in this budget, but it was worrying for university students of the future.

“(It could be detrimental) if people can’t afford to have a degree, who have amazing brains that could be solving problems and creating cures for cancer, but not able to afford university,” she said.

Who: Jackie and Greg Walker

Age: 30s

Where: Melbourne, VIC

Work: Small business owner with one child

Verdict: Happy with the outcome

As expected, the tax burden for small business owners will be lowered to the tune of 1.5 per cent.

To help small businesses invest in new tools or machinery the Government will provide an immediate tax deduction of all assets under $20,000.

Small businesses can buy as many items under that amount as they like and receive that deduction on each one, starting from budget night.

“Fantastic budget,” Jackie said.

“As a family the biggest and best news for us was the company tax reduction. We own and run two small businesses so this is a huge saving for us.

“We are absolutely thrilled that money is being put into reforming child care, giving us more options in the future.

“The changes in paid parental leave don’t affect us greatly as Greg can support us without me working. I only work because I want to.”