These are the changes that will affect your superannuation savings over 2024

Super reforms will give members a better view on their fund's spending. Photo: Getty

Superannuation will be the focus of changes in 2024 that aim to improve equity and provide members with better service.

Currently superannuation funds can only offer limited financial advice, unless you choose to become a client of a financial adviser that has a relationship with the fund. And that costs you money.

However, this is about to change following the Delivering Better Financial Outcomes package released by the Albanese government in mid-2023.

Although the legislation for this has yet to appear and pass Parliament, it is expected to offer significant advantages to super fund members.

Firstly, and controversially, the government plans to change the best interest test for financial advice introduced after the Hayne banking royal commission in 2018.

Instead it is likely to be replaced by a “good advice” test, giving more flexibility to advice providers.

Consumer groups have panned the idea.

CEO of consumer group Choice Alan Kirkland warned against “radical changes that … will expose consumers to unacceptable risk when obtaining financial advice from a bank or super fund”, when the government first made its plans known in 2023.

However, a spokesperson for Assistant Treasurer Stephen Jones told The New Daily that any changes “will absolutely not reduce the standards of protection for consumers”.

What the changes will also do is “address the large and growing gap in the availability of retirement advice by expanding the provision of personal advice by superannuation funds to their members”, according to the roadmap released by Jones.

“There are 16,000 financial advisers and five million people are approaching retirement, so those numbers don’t square up,” Jones’ spokesperson said.

What the government plans is to increase the scope of general advice allowed to be offered by super funds, meaning it will be available to far more people.

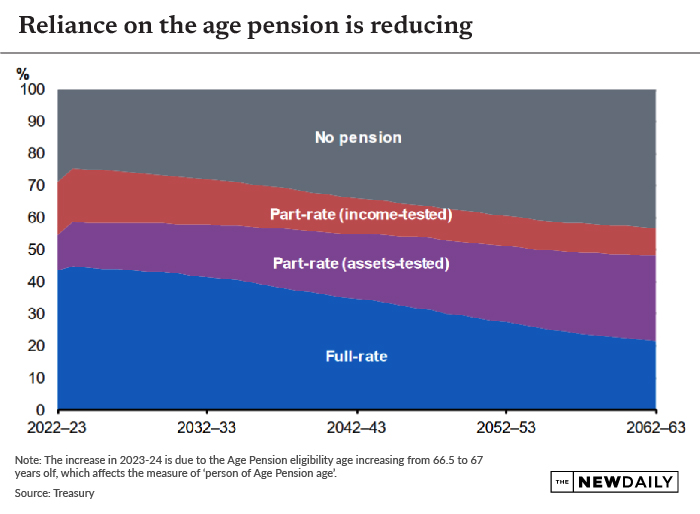

And more people getting good advice will further reduce reliance on the age pension over time – at least, that’s the theory.

Under the new rules, “if you’re going to offer someone retirement advice you can take into account their partner’s position as well as their own and look at issues like how to deal with their eligibility for the age pension”, said David Knox, director of superannuation group Mercer.

Consequently, far more people will be able to get affordable and relatively simple personal advice from their super fund without having to employ a financial planner for a comprehensive plan.

“Most people don’t want to pay $5000 for a piece of comprehensive advice,” Knox said.

Taxing big super balances

In a major move targeting increased equity, Treasurer Jim Chalmers will increase the tax on balances of $3 million and above.

In legislation not yet introduced to Parliament, Chalmers will double the tax on superannuation earnings from 15 to 30 per cent for any portion of a super balance of $3 million or more.

What we know of the plans are raising ire in some quarters because the government plans to levy the tax on earned and unearned gains.

That means the fund will be measured on July 1, then June 30, and any increase in value – minus contributions – will be taxed at 30 cents in the dollar.

That breaches a long-held Australian tax principle that tax should only be paid on realised gains.

Some industry lobbyists have said that will make life difficult for self-managed super funds with illiquid property assets that are hard to break up for sale.

However, Chalmers retorts that the move will hit only 80,000 people, or 0.5 per cent of super accounts.

He says it will raise an extra $2 billion of revenue annually.

Remember, this tax is not scheduled to operate until July 1, 2025. But expect to see plenty of political heat about it in 2024 when the legislation is released.

People who are likely to fall under its net will likely begin taking action, such as taking money out of super during 2024 to get around its provisions.

Deeming rates

Deeming rates are the returns the government assumes you are earning on financial assets and are used to help establish your eligibility for government benefits and pensions.

Financial assets include bank deposits, term deposits, shares and equity funds.

They have been reduced in recent years to account for the low-interest rate environment we lived through earlier in the decade.

That cut was meant to ensure people didn’t lose benefits by the government assuming their investments paid them more money than they actually did.

But interest rates have been on the rise for some time and the government plans to end the low deeming rate holiday from July.

We don’t know yet what the new rates will be. But if you are receiving a pension, it is a good idea to start thinking what to do if any rise in deeming rates cuts it.

More detail for members

Another new set of rules out for discussion with the super industry are arrangements that will compel the funds to tell their members in greater detail how they spend their money.

The increased scrutiny would be over how funds spend their advertising and market budgets, how they set their fees, and how funds failing the APRA performance test plan to get back on track.

The New Daily is owned by Industry Super Holdings