Go moderate, go late, go small business!

Minister for Small Business Bruce Billson. AAP

When Kevin Rudd asked Treasury secretary Ken Henry how best to stimulate the economy back in 2008, the advice was clear – “go hard, go early, go household”.

Well times, and governments, change. This year’s budget contains a stimulus package all its own, badged as a ‘Jobs and small business’ package. But this time it might better be summed up as: ‘go moderate, go a bit late, go small-business’.

• Winners and losers of Budget 2015

• Paul Bongiorno: a budget to save Joe’s bacon

• Uni reforms Pyne-o-cleaned from Budget 2015

• Go moderate, go late, go small business!

• The strangest measures in Budget 2015

• Welfare cut from anti-vaxers

• Tourists slugged for budget repair

But let’s not be churlish. Overall, the $5.5 billion ‘Growing jobs and small business’ package is a good idea. The economy and federal finances are both dangerously weak, meaning initiatives to stimulate small business and create jobs without splurges of public money are just what’s needed.

Minister for Small Business Bruce Billson will have something to smile about now. Photo: AAP

The problem, of course, is that they were needed a year ago – that’s the ‘bit late’ part of the package.

The three main planks of the package, aimed at SMEs turning over less than $2 million, are:

• a 1.5 per cent reduction in company tax for incorporated SMEs (costing $1.45 billion over four years);

• a 5 per cent tax discount for non-incorporated SMEs up to a maximum of $1,000 per year (costing $1.8 billion) and;

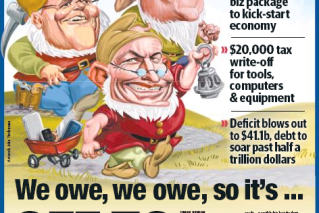

• a frenzy of instant-asset tax write-offs for SMEs (costing $1.75 billion).

A suite of much smaller measures are included aimed at getting disengaged young workers back into jobs, wage subsidies for bosses who’ll give them a go, and the Coalition’s ongoing war on the costs associated with ‘red tape’ regulations.

Now here’s the political point. To benefit directly from these changes, you have to be a small business owner, a sole trader or sub-contractor, and that means you’re more likely to vote Liberal already.

Labor and the unions won’t like that, though it’s important to remember that the instant-asset write-off plan was originally brought in by Labor (though only for items up to $6,500), scrapped by the Abbott government due to its link to the carbon and mining tax packages, and now reinstated in grander style.

The instant asset-write-off measure is smart because it leverages private investment – the government pays the tax write-off at tax time (let’s say 20 to 30 per cent depending on taxation circumstances), but the individual SME still stumps up the money for the productivity enhancing investment.

Whether nervous small businesses take the tax cuts and use them to improve the bottom line, or whether they actually create new jobs is yet to be seen.

But either way, a flurry of SME purchases is a mostly-private-funded way to increase final demand in the economy, help push up the too-low inflation rate (1.9 per cent in 2014-15) and get things moving again. That’s stimulus, even if Mr Hockey doesn’t want to call it that.