Living overseas on an Aussie pension: smart move or rort?

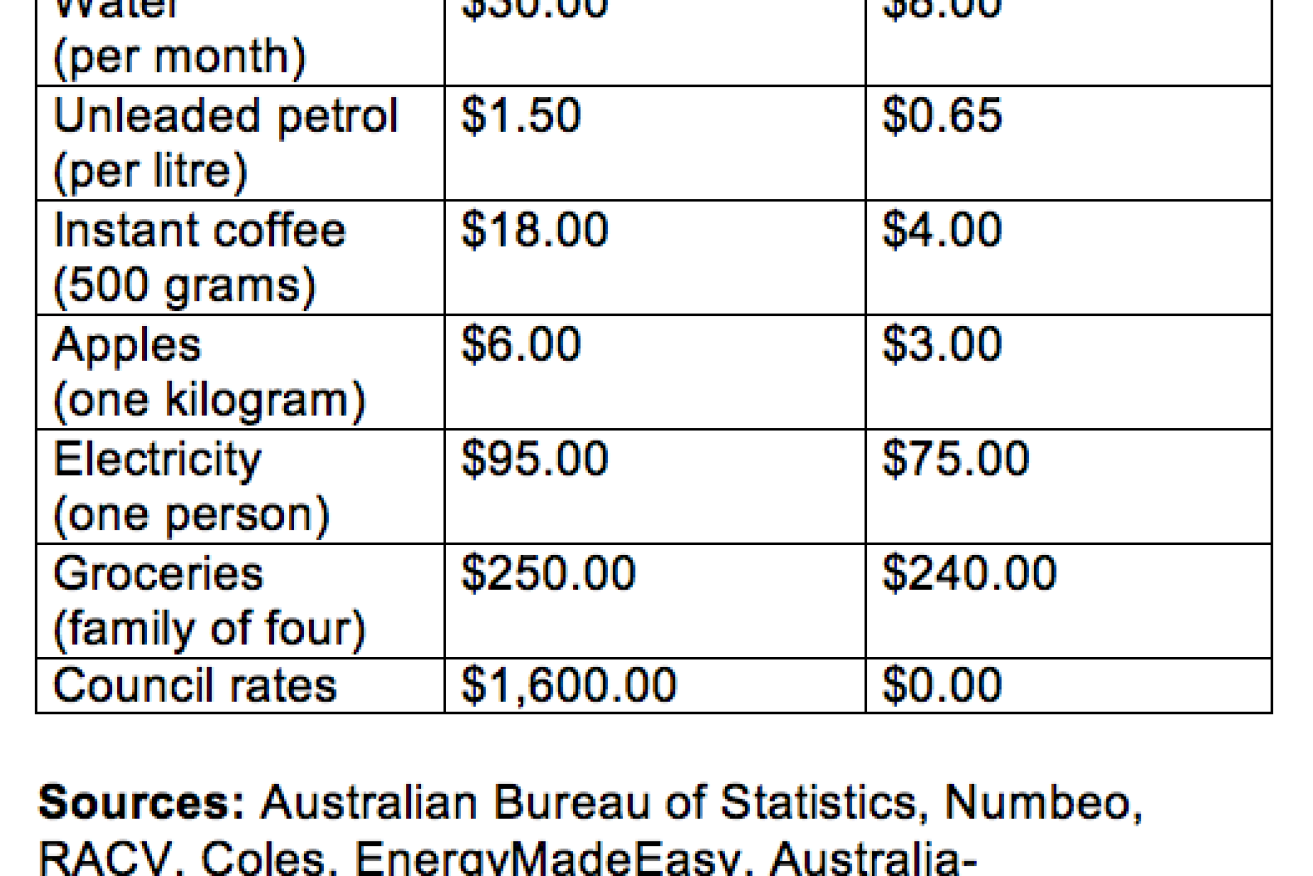

ABS, RACV, Numbeo, Coles, EnergyMadeEasy, Australia-migration.com, Richard Laidlaw.

Richard Laidlaw, 69, an ex-journalist from Queensland, is one of the grey Australians who has renounced what he calls his “restrictive and rule-bound” homeland for the island paradise of Bali.

Like many others, he finds Indonesia to be a cheaper and more laidback place to retire.

“It is possible to live much more cheaply outside Australia,” he says.

“Living somewhere that offers a cheaper alternative to high-cost Australia means people like me can make their own funds last longer.”

• Older workers face jobless future

• Want to retire before 70? Then fight for the super safety net

• Essential money tips for 50-somethings

But quirks in the age pension mean that Laidlaw could be forced back to Australia out of financial need. Despite having a small enough pool of assets and a low enough wage to qualify, red tape means he cannot receive the pension without returning home for 24 months.

“In order to access the pension now, I would have to return to Australia permanently and remain there for two years. I’d get the pension, and all the other add-ons, during this period, but would lose the pension if I went overseas for more than a short holiday during that period.”

Laidlaw became eligible for the pension the year he moved to Bali in 2009, four years after he moved to Bali. He is comfortable in his new country, and doesn’t want to be uprooted again by what he calls the “you must return home rule”. He thinks the government should make it easier for Australians to live out their days in foreign countries.

“Other countries pay age pensions to citizens who choose to retire overseas. Why can’t Australia do this?” he asks.

Using the system …

The issue for the government is that these welfare payments are flowing straight offshore, effectively subsidising the idyllic lifestyles of retirees without any money flowing back into the local economy. But as the costs of living continue to rise in Australia, more and more needy retirees may look further afield to stretch their welfare dollar.

While the age pension has been quarantined from its cost-cutting review of the welfare system, the government is looking at other ways to rein in the pension, including upping the working life requirement from 25 to 35 years. This would mean that pensioners who have lived in Australia for less than 35 years would receive lower rates of payment.

According to the Minister for Human Services Marise Payne, the majority of overseas welfare recipients are living in Italy (16,800), Greece (13,700) and New Zealand (11,300), with the “vast majority” of these receiving the age pension.

“We pay just over $770 million to people who are receiving pensions who are living outside of Australia,” says the Minister, who explains the tightening of pension requirements as necessary to the “management of the budget”.

… or just desserts?

CEO of National Seniors Michael O’Neill is strongly opposed to restricting the pension, describing those measures as “scrooge-like”.

“The Minister gets into murky territory if she wants to reflect on that, because there are a whole lot of allowances and opportunities that people in the employ of government remain eligible for and are only too willing to access,” he says.

But O’Neill says it would be concerning if more Australians retired overseas, particularly in developing countries, because of the medical risks.

“I think folk who are considering that path need to think long and hard about first-world health services versus third-world health services,” he says. “The depth and quality of the services that will be on offer there may well be quite different to what your expectations are.

“It might be great if you’re 65. If you’re 75, medical science tells you you’re going to run into more problems.”

Beware the pitfalls

Tom Mulally, an expat blog writer and passionate evangelist for retirement in Bali, says the island is a great place for Australians looking to settle down.

“Bali is a world-class combination of relatively inexpensive living costs (for expats, not tourists) with infrastructure rivalling what you might find in a major metropolitan area,” he says.

“For retirees, a pension will still go far further than it will in Australia, and in many ways once you get set up and your pembantu [domestic helper] knows your habits you’ll probably find your standard of living is in many ways better than how you lived back home.”

But he acknowledges that health care is “the major caveat”.

“If you need emergency health services here, you cannot expect an ambulance to arrive and take you to a Western-style emergency room,” says Mulally. “Active people who are lucky enough to find themselves in good health during their retirement years are most suited to becoming retired expats, there’s no doubt about it.”

The biggest argument against a growth of offshore pensioners seems to be that they will be a drain on the economy, without giving back in any way.

But Laidlaw thinks overseas retirement is not only a money saver for older Australians, but for the government as well.

“If eligibility policy was amended and more people chose overseas retirement, that would have a positive impact, of some small measure, on the substantial on-costs associated with age pensioners living in Australia,” says Laidlaw.

“Overseas pensioners would not be accessing free or concessional healthcare or getting petrol and local government charges rebates, free bus and train travel, and so forth.”

Regardless of whether overseas pensions are a burden or a blessing to the federal budget’s bottom line, the idea of living a carefree existence in a tropical haven, or returning to live with family in Europe, is sure to entice a growing number of elderly Australians who struggle to pay the rent and put food on the table.