Australian housing may have peaked, analysis shows

A combination of tighter lending rules, looming over-supply of apartments and slowing migration rates look like unravelling a housing-led recovery, according to new analysis from Morgan Stanley.

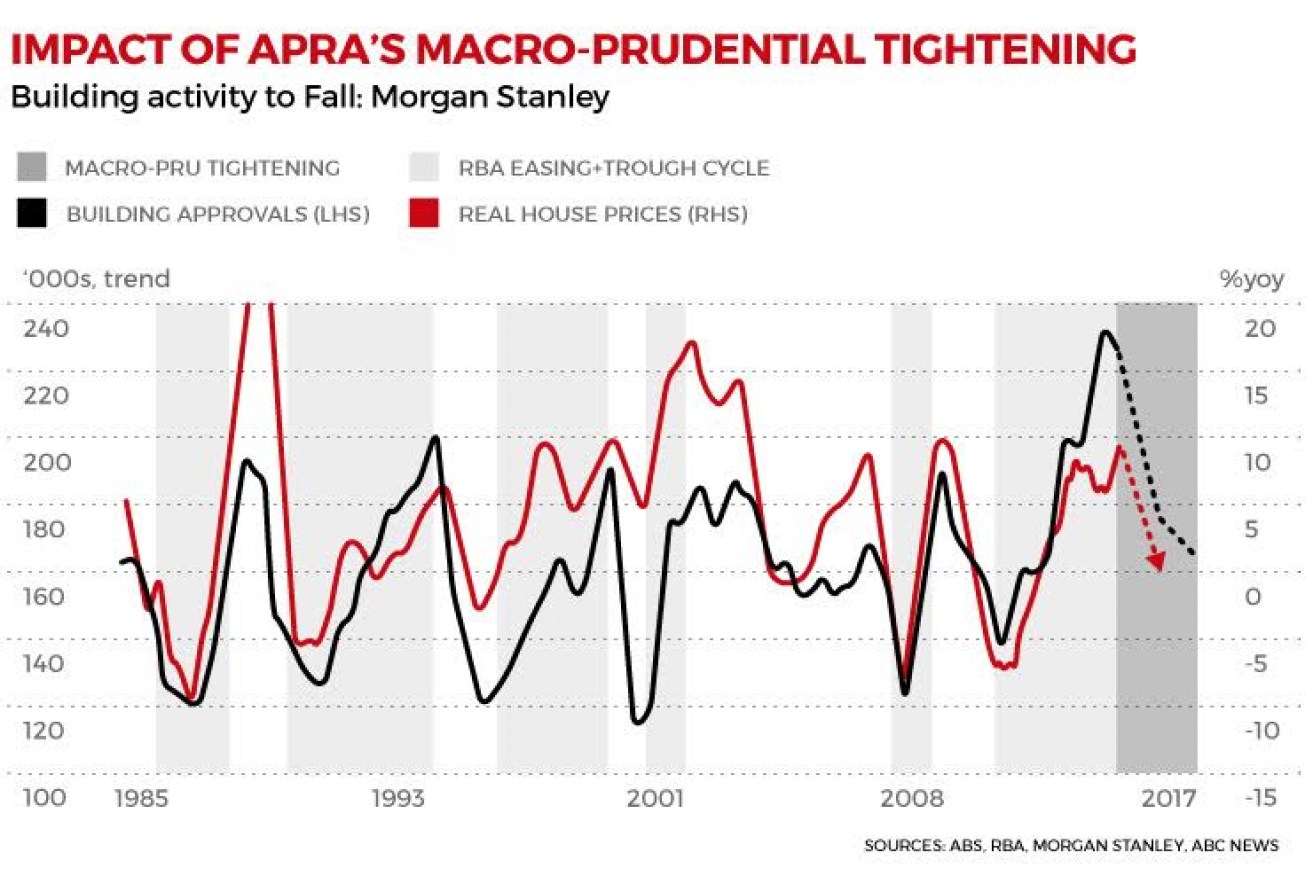

The investment bank’s strategy team has released a research note suggesting housing activity has peaked, and efforts by the Australian Prudential Regulatory Authority to cool soaring property prices will not only take growth momentum lower, but also raise the risks of recession.

The Morgan Stanley thesis is that while the Reserve Bank’s low interest rate policy has “over-delivered” in terms of housing activity, APRA’s move to tighten macro-prudential screws to limit lending — particularly to investors — is the equivalent of a new tightening cycle with interest rates.

• ASX 200 dips below 5000 after global rout

• Home borrowing gets tougher

• China manufacturing at six-year low

“Clearly the housing sector delivered above and beyond the call of duty, especially after the RBA was pushed into cutting rates another 50 basis points (in the first half of the year) by a miscalibrated 2014 Budget,” Morgan Stanley wrote into a note to clients.

“We believe regulators have been forced to tighten macro-prudential policy, despite the likely cost to growth,” Morgan Stanley’s Daniel Blake said.

In recent months APRA has imposed several brakes on investment lending to impose a 10 per cent growth “speed limit” on the banks.

The measures include:

– Serviceability tests were imposed on a borrower’s ability to repay loans after APRA revealed that the most generous lenders were prepared to lend up to 50 per cent more than their more cautious competitors.

– Interest-only mortgages were wound back after ASIC found that a number of lenders had miscalculated repayment profiles, rather alarmingly in 40 per cent of cases reviewed.

– Investor mortgage rates were raised by around 100 basis points (or a full 1 per cent) through a combination of investor discounts being cut and increases in the standard variable mortgages.

– APRA’s move to increase the “Big Four” banks’ mortgage risk weightings – to boost their capital buffers – has also had a significant upward impact on investor and interest-only loans.

Apartment ‘credit crunch’ likely

Mr Blake argued APRA’s “speed limit” would not only take some of the heat out of the market, but more importantly risked a credit crunch in the apartment market which was expecting a surge in settlements over the next 12 months.

Morgan Stanley expects demand for apartments to fall. Photo: Shutterstock

Around 100,000 new apartments are expected to be completed by next June, with around two-thirds typically being snapped up by the “buy-to-rent” investor set.

“On our back-of-the-envelope calculations … this [settlement pipeline] equates to about 55 per cent of the available ‘quota’ under the APRA speed limit to mid-2016, presenting the real risk of a credit crunch as they come due,” Mr Blake said.

A slowing intake of migrants will do nothing to help the housing sector. Recent ABS figures showed net migration slowed to annual rates of 184,000, down from the federal government’s forecast 235,000 this year and 255,000 in 2016.

Mr Blake said the 70,000 shortfall equates to a decline in demand of around 30,000 new properties, “a substantial miss to our forecasts and those previously assumed by policy-makers, including the RBA”.

On top cooling demand, a strong flow of supply is working through the pipeline – commencements have been tracking at a record pace of more than 200,000 a year over since the start of the year.

Morgan Stanley forecast this will tip the housing market from about “balanced” at present into a modest oversupply, with rental vacancy rates likely to track up towards historical peaks.

“We are now calling the peak in the housing cycle, and expect further falls in auction clearance rates and house price momentum, with a negative impact on construction occurring over 2016,” Mr Blake said.

Recession risks are elevated

As Mr Blake points out, the housing slowdown comes at an awkward time, with a drag on GDP from resources investment continuing through 2016, overwhelming the contribution from the lower Australian dollar and rising services exports.

“Another concern regards the potential impact on the labour market, with the strong take-up of jobs into construction and housing-related sectors unlikely to continue at this pace through 2016.

“Even taking into account the greater job-creation in the services sector … 2016 should see employment growth come in … below 1.1 per cent, with unemployment rising to 6.8 per cent by end-2016 on our projections.

“We believe recession risks are elevated as regulators attempt a difficult soft-landing of the housing market amidst external and income challenges,” Mr Blake warned.

Morgan Stanley already has forecast Australia’s GDP growth will slow further to 1.9 per cent and will probably require another 50 basis points of interest rate cuts from the RBA, the timing of which depend on how rapidly housing activity cools, as well as the extent to which it spills over into headline unemployment.

-ABC