RBA Governor warns prices battle isn’t over yet

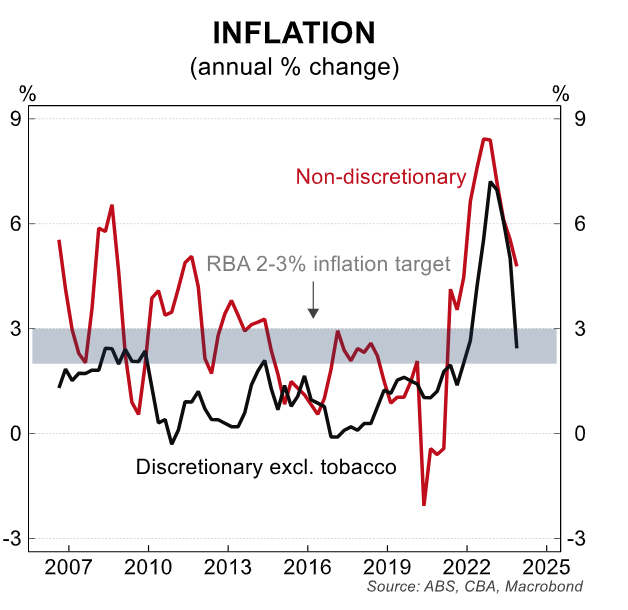

Interest rate hikes have been paused after inflation fell to 4.1 per cent annually over the December quarter, but Commonwealth Bank chief economist Gareth Aird said on Friday that prices for non-discretionary goods are still rising much faster at about 4.8 per cent.

“Non‑discretionary inflation remains quite elevated. It has primarily been a tale of four expenditure items; the cost of building a home, rent, electricity and insurance,” Aird said.

“These are all housing related.”

The analysis came hours before RBA Governor Michele Bullock declared the battle against inflation wasn’t over yet, telling a Senate committee hearing that an inflation rate with a “four” in front of it “isn’t good enough”.

And that means there’s still a remote possibility of another rate hike.

“One thing that has not changed since our previous hearing in 2023 is the challenge presented by high inflation,” Bullock said.

“We all remain acutely aware that the cost of living is rising much faster than it has over recent decades.”

A shortage of suitable housing and tax breaks for property investors have been blamed by experts for the massive increase in housing costs.

ABS figures for the December quarter show rents rose 7.6 per cent annually, following an increase of 7.3 per cent in the previous quarter.

Aird said that key price pressures on households cannot be addressed by the Reserve Bank, including insurance premiums, which have soared over the past year.

Insurance prices rose at the fastest rate since 2001 over the December quarter, skyrocketing 16.2 per cent on an annual basis.

“Insurance prices have been driven sharply higher by a large increase in premiums for house insurance,” Aird said.

“The big lift in the cost of building a home over the past two years as well as natural disaster costs have generated a commensurate lift in insurance premiums.”

Source: Commonwealth Bank (click to enlarge).

Good news

The good news is that while housing-related costs will continue to be elevated, inflation in discretionary goods has fallen significantly, putting the economy on track for rate cuts in the second half of the year.

The Commonwealth Bank has forecast a rate cut for September.

“There will be pockets of both goods and services inflation that prove a little sticky because monetary policy is unable to directly influence price changes for some non‑discretionary components of the basket – particularly those influenced by strong population growth,” Aird said.

“But overall we expect ongoing disinflation to be the key theme in 2024.”

Bullock has made similar comments in recent weeks, suggesting that the ability of monetary policy to reduce housing-related costs was limited.

But Bullock has been much more tight-lipped on the outlook for inflation this year and what that might mean for interest rates, saying earlier this week that the central bank would not provide an outlook.

Productivity key: Bullock

One potential trigger for an interest rate hike could be lacklustre productivity growth, which combined with an ongoing rise in wages could renew inflationary pressures, Bullock said.

“If productivity doesn’t rise, then what’s going to happen is that the rate of increase in wages is going to have to slow as well,” Bullock said.

“If there’s more productivity, then you can pay your workers more because they’re worth more, they’re producing more.

“It just means that we have to make sure that we bring demand back down so that businesses, when they’re facing these costs increases, they’re thinking twice about whether or not (they) can pass these cost increases on.”