Migration to save Australia from recession in 2024 as weaker economy hits families

Households are set to experience sub-par disposable income growth for years to come. Photo: Getty

Australians should brace for a weaker economy in 2024 as higher interest rates force families to tighten their belts, but the country should avoid a recession this year due to strong migration.

Forecasts published on Wednesday by Oxford Australia foreshadow a new phase in the cost-of-living crisis defined by a looming peak in interest rates and continuing financial pain for families.

Analysts predict a per-capita (population-adjusted) downturn will likely continue into 2024 as consumers, which account for two-thirds of the economy, struggle with financial pressures.

But Oxford Australia’s head of macroeconomic forecasting Sean Langcake said that budgetary pain will be tempered in aggregate because population growth is set to remain quite strong.

In other words, while individual families are doing it tougher and spending less on goods and services, there are enough new people coming into the economy to ensure growth continues.

Budget projections for net overseas migration are 316,800 in 2023-24 and 261,800 in 2024-25, which is markedly lower than the past financial year but still well ahead of longer-term averages.

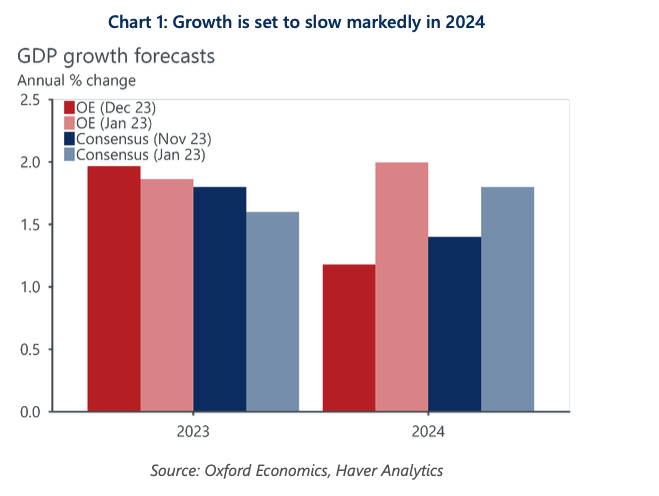

That should translate into annual GDP growth remaining above 1 per cent, Oxford predicted, which would be well below the 2.1 per cent posted over the year to the September quarter.

“It’s still very much a population growth story,” Langcake said of Australia’s growth prospects.

Source: Oxford Australia (click to enlarge).

Migration to stave off recession

The Oxford forecasts paint a picture for the economy that has many similarities to last year, when strong population growth was enough to offset three quarters of a per-capita downturn.

On one hand that’s positive because it means a spike in unemployment is unlikely, particularly as strong population growth to date hasn’t really disrupted the jobs market, with analysts saying migrants added as much to labour demand as they have to supply in the post-pandemic period.

But while population growth will bulwark the economy against an outright recession, the influx of people will add to pressures in the housing market because supply can’t shift to meet demand.

That means rents and, to a lesser extent, property prices will stay elevated, even if the former is unable to keep growing at the breakneck pace of last year simply because people can’t afford it.

“There’s a limit [to how high rents can rise], but that doesn’t mean there’s light at the end of the tunnel, either,” Langcake said.

An increasing reliance on migration as the backdrop of growth is also more risky, Langcake explained, because it means the economy can’t readily fall back on consumer wallets to grow.

Construction sector key to growth outlook

In that context the outlook for the construction sector is key to the growth outlook in 2024, because it can help ease housing market pressures and drive forward GDP growth.

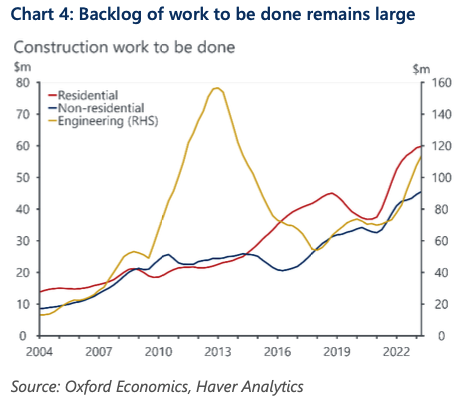

Oxford Australia noted that construction enters 2024 with a sizeable backlog of projects to clear, notably including projects that began under the HomeBuilder program during COVID-19.

The ability of the sector to complete these projects and begin addressing new demand is a big uncertainty, particularly after a difficult period for builders struggling with soaring inflation rates.

“We remain cautious on how much work will be realised as dwelling investment in 2024, as the sector is still struggling against capacity constraints,” Oxford Australia analysts said.

“However, if build times do recede, the large backlog of work means there is considerable upside risk to our outlook.”

Source: Oxford Australia (click to enlarge).

The choppy performance of the construction sector was evident on Wednesday when ABS data showed dwelling commencements plunged 10.4 per cent towards the end of last year.

The September-quarter figures showed private house commencements were down 9.7 per cent.

Commonwealth Bank economist Harry Ottley said the level of new dwelling starts was the lowest in about a decade, which does not bode well given the state of the housing market.

“The housing shortage in Australia means that underlying demand for new dwellings is high,” Ottley said.

“But a variety of forces are working to subdue activity; higher borrowing costs, elevated inflation for new dwellings, poor consumer sentiment, uncertainty around the path of the cash rate, as well as concerns about the health of the construction sector are all weighing on near-term activity.”