Christmas mortgage squeeze looms as RBA prepares fresh interest rates hike: Economists

RBA boss Michele Bullock said the conflicts in Ukraine and the Middle East could slow global growth. Photo: AAP

Australians are being told to brace for another painful mortgage bill squeeze this week, with economists tipping a fresh hike in interest rates when the Reserve Bank meets for November.

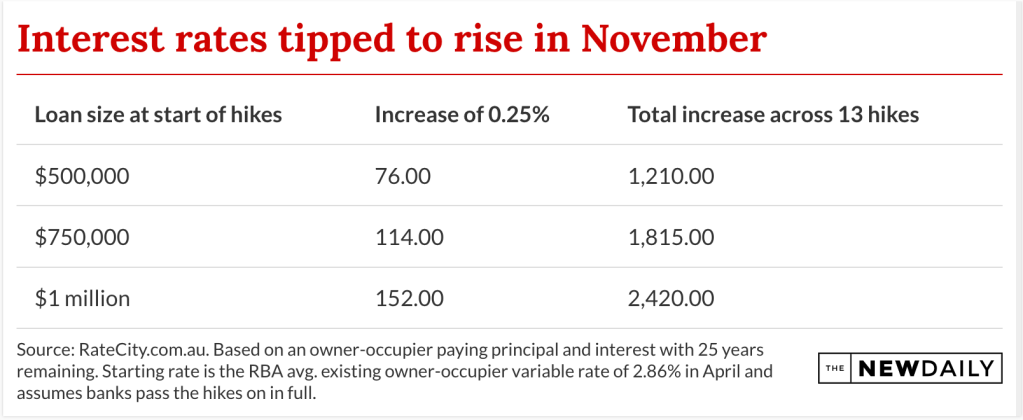

More than two-thirds (69 per cent) of experts surveyed by Finder expect the RBA will move its cash rate target from 4.1 per cent to 4.35 per cent on Tuesday, which would add about $79 to monthly repayments on a typical $500,000, 25-year home loan, according to RateCity figures.

It would be the first rate increase since June, when central bankers paused to consider whether inflation was easing fast enough to reach the RBA’s 2 to 3 per cent target band by late 2025.

Much has changed in the past week, though, with higher-than-expected underlying inflation over the September quarter and a bump in retail sales testing the patience of the RBA board.

Oxford Australia head of macroeconomic forecasting Sean Langcake said the RBA’s forecasts for inflation in 2023 have been “blown out of the water”, which should trigger a November hike.

“There’s probably more bite than bark in that ‘lower tolerance’ guidance [from the October RBA meeting minutes,” he said.

“At this point, it’s going to look very odd if they don’t hike.”

Commonwealth Bank chief economist Gareth Aird also expects a hike pointing to a declaration from RBA boss Michele Bullock that the RBA wouldn’t hesitate to respond if inflation came in too high.

“A November rate hike would marry up with the RBA’s rhetoric that it will do what is necessary to return inflation to target within a reasonable time frame,” he said.

Christmas mortgage squeeze looms

It raises the prospect of a fresh squeeze for millions of mortgage holders before Christmas, with more than $1100 having already been added to monthly repayments on a typical mortgage since May 2022 (when the Reserve Bank began increasing rates from pandemic-era lows).

As things stand, rates of mortgage stress have already soared to record highs, according to data consultancy Roy Morgan, while prices for essentials such as power and petrol continue to rise.

Impact Economics lead economist Angela Jackson said the latest figures showed a need to slow the economy further to bring down inflation, though such a move also comes with risks.

“This needs to be weighed against the current per capita recession and the risks of higher unemployment,” Jackson said.

Multiple rate hikes to come

The RBA will also publish updated economic forecasts next week that will provide additional insight into the path for interest rates beyond November.

Economists are expecting there may be a slight upwards revision to inflation predictions on the back of the September-quarter data.

Langcake said if the RBA does opt to hike rates in November there will most likely be another increase on the way in December.

“One brings two,” he said.

That would mean the spectre of even higher mortgage repayments will hang over home owners during the Christmas holidays, though actual bill increases from the rises would take months.

University of Sydney professor James Morley said the prospect of higher interest rates reflected the RBA’s focus on ensuring inflation expectations remain “anchored at low levels”.

He said the risk of a recession is now “receding”, which gives central bankers room to again raise rates without an unacceptable risk that the economy will be pushed into a downturn.

“I suspect that domestic components of inflation will make more progress back towards target before the February meeting and then the RBA will hold unless there are further domestic or global shock,” he said.