Should the government be spending more to lift the economy?

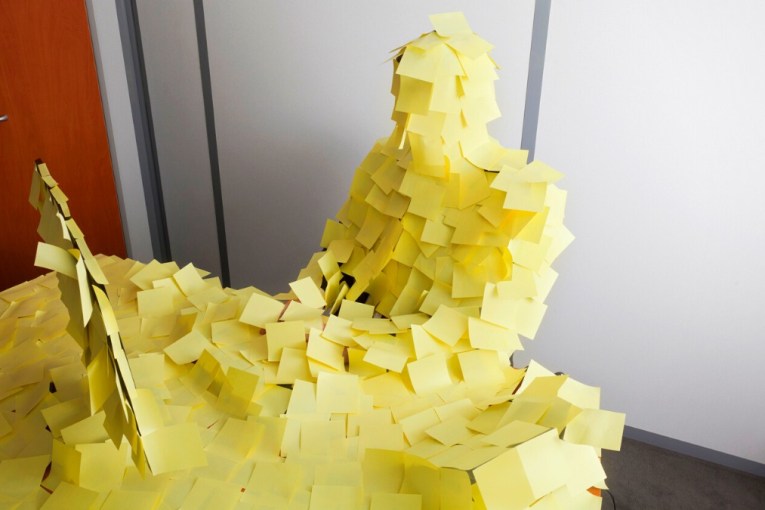

The battle lines on the economy have already been drawn. Photo: AAP

Australia’s economic battle lines are clear for all to see.

The opposition is calling on the government to spend more to lift the economy, after growth dropped to its slowest pace since the GFC.

The Coalition says it won’t do anything that risks its projected budget surplus, as it needs to pay off Labor’s debt.

But how much debt does the government hold?

And what effect does that have on the economy?

How much debt does the government hold?

At the end of the last financial year, the Australian government had a net debt of $373.6 billion, which equates to 19.2 per cent of GDP.

That’s far lower than most advanced economies, which have an average net debt of 75.81 per cent of GDP, according to the International Monetary Fund (IMF).

Looking at debt as a percentage of GDP is the best way to measure a country’s indebtedness, as it takes into account a country’s assets and scales the debt to the size of the economy, which determines the country’s ability to repay that debt.

Because of its low debt levels and the cheap borrowing rates on offer, Australia has plenty of room to stimulate the economy when the time comes to offer a helping hand.

“And a lot of people would argue the case that that time is now,” said IFM Investors chief economist Alex Joiner.

How much government debt is too much?

There’s no hard and fast rule, according to independent economist Saul Eslake.

Among other things, it depends on the interest rates paid on the debt, the country’s pool of domestic savings, and the purposes for which the government borrowed the money.

“At current, very low interest rates on government debt, the level of debt which governments can sustain is higher than it was a decade ago,” Mr Eslake told The New Daily.

“The German and Japanese governments are in effect being paid to borrow money, because they’ve got negative interest rates, so it depends on the circumstances and it depends on the country.”

University of New South Wales economics professor Richard Holden agreed the Australian government had plenty of room to take on more debt.

“Twenty per cent, 30 per cent, 40 per cent – that’s an incredibly safe level [of government debt],” Dr Holden told The New Daily.

“The worry [with spending more] is if you bake in a structural budget deficit, rather than stimulatory spending … so permanently large and increasing deficits for ever more.”

Dr Holden gave the Greens’ policy of a universal basic income as an example of this type of spending.

When is it a good idea to run a budget deficit?

According to AMP Capital senior economist Diana Mousina, governments should ramp up public spending when economic growth is slowing and interest rate cuts are having little impact.

“Which is where we’re at at the moment,” Ms Mousina told The New Daily.

Large-scale infrastructure projects provide an immediate jolt to the economy by creating jobs and boosting activity.

And if done well, they also lift the country’s productivity over the long term.

This means greater public spending often pays for itself, as greater productivity lifts wages and profits, which boosts tax revenues later down the track.

Is it a good idea to run a budget surplus?

Generally speaking, governments should aim to run a balanced budget over the course of an economic cycle.

This means running a deficit when growth is slow, and running a surplus when growth is strong.

The main benefit of running a surplus is to provide a buffer for spending down the track.

Why is the government intent on delivering a surplus?

The government is committed to achieving a budget surplus because that was its main election promise.

Despite most economists calling on the government to ramp up spending, the Coalition has made it clear it won’t be loosening its purse-strings in a hurry.

After repeatedly pointing to its projected budget surplus as evidence of its superior economic management, failing to balance the books would cause untold damage to the Coalition’s political reputation.