Morrison is misleading the electorate on his income tax-cut plan

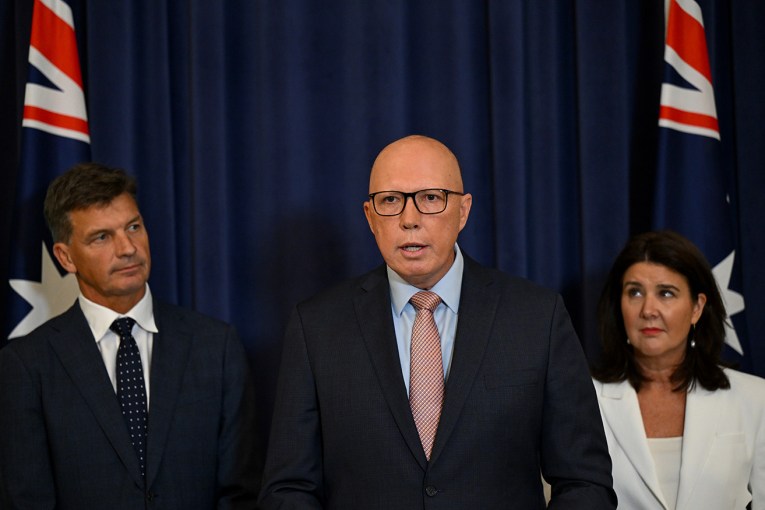

The Treasurer refused to comment on evidence he was misleading voters. Photo: AAP

Treasurer Scott Morrison has refused to answer claims he is knowingly misleading the electorate, despite Treasury figures powerfully discrediting the claim that his income tax cuts will target middle-income earners.

Last week the government claimed the main beneficiaries of its plan to scrap the 37 per cent tax bracket would be middle-income Australians.

Here’s what Treasurer Scott Morrison said, as reported by Fairfax: “The real beneficiaries [of the tax cuts] are those who sit in the middle of the pack and either side of it.”

He said the government’s personal tax plan was “very much anchored around middle incomes, not just now but into the future”.

By “the middle of the pack” Mr Morrison was referring to people who earn between $120,000 and $200,000 a year.

The New Daily ran a piece debunking this claim earlier this week. But since then information from Treasury has added even more evidence to the case that the government’s claims are false.

Given this information comes from Mr Morrison’s own department, it could be argued that Mr Morrison is knowingly misleading voters.

Treasury’s figures

In 2024-25, the government plans to scrap the 37 per cent tax bracket and lift the lower threshold for the top marginal tax rate of 45 per cent to $200,000 a year.

This will cost the federal coffers $42 billion over four years, and benefit anyone earning more than $120,000 a year – including those earning more than $200,000. In fact it will benefit them most of all (see below).

Official Treasury modelling, which you can view for yourself here, projects that in 2024-25 there will be 13.05 million taxpayers in Australia. Of those, 10.44 million will earn less than $120,000 a year.

In percentage terms, that’s 80 per cent of people earning less than $120,000.

Only one in five taxpayers, or 20 per cent, will be earning more than that. And just under 14 per cent will be earning between $120,000 and $200,000 a year.

That 14 per cent is Mr Morrison’s supposed “middle of the pack”.

To be fair to Mr Morrison and The Australian, their figures were based on 2028.

The Treasury’s figures don’t stretch that far. But if the trends Treasury uses continue, by 2028, 24 per cent of taxpayers will be earning over $120,000, and the rest (76 per cent) will be earning less than that.

In other words, the vast majority of Australian taxpayers will still be earning less than $120,000.

That’s 76 per cent of taxpayers. It excludes working adults who earn less than $18,200 a year, non-working adults, full-time parents, students, pensioners, self-funded retirees, children and so on.

Currently the population of Australia is around 24.7 million, and it is growing at a rate of 1.6 per cent a year.

If that continues, by 2028 the population of Australia will be approximately 29 million.

So if you include all Australians, not just those who are working, Mr Morrison’s abolition of the 37 per cent tax bracket benefits just 12 per cent of Australians. That’s Mr Morrison’s “middle of the pack”.

Australia’s wealthiest save thousands

As for how much money people will save, Treasury’s figures are quite revealing. Put simply, the more you earn, the more you save.

Mr Morrison’s three-part income tax cut plan is supposed to be completed in the 2024-25 tax year.

In that year someone on $60,000 a year will save $540 a year from the entire plan.

Someone on $90,000 a year will save $675.

Someone on $120,000 a year will save $2225.

Someone on $150,000 a year will save $3375.

Someone on $180,000 a year will save $4725.

And everyone earning $200,000 a year or more – that’s just 6 per cent of taxpayers – will save $7225 a year.

In other words, the wealthiest 6 per cent will get a tax break 13 times greater than someone on the median income.

The New Daily put all these figures to Mr Morrison’s office, but received no response.