Royal commission: ANZ took 10 years to repay home loan overcharges

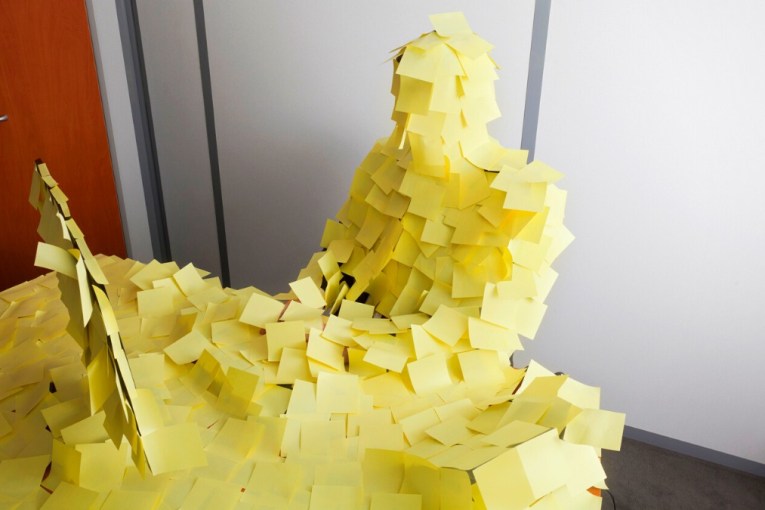

ANZ has raised home loan rates. Photo: AAP

ANZ was forced to pay $69.3 million in recompense for overcharging customers on home loans due to malfunctions in its ‘Breakfree’ home loan and mortgage offset accounts, the financial services royal commission has heard.

ANZ home loan chief Sarah Stubbings told the commission that the mis-pricing problems went on from 2003 to 2013. And she said that the glitches continued after that because solutions introduced did not cover people who chose to move to the products while already clients with the bank.

To date, the bank has made remediation payments to 235,000 customers who were caught up in the issue. A further 165,000 clients who had been impacted by less than $2 in an open account or less than $20 in a closed account were not personally compensated.

The monies due to them were given to charity and totalled $716,000.

The problems with the accounts worked in two ways. Customer offset accounts, which offset mortgages with savings balances, were not correctly linked and Breakfree mortgage account interest rate discounts were not calculated correctly.

The payments were made over about six months.

“We remediated offset customers by December 2012 and Breakfree customers by July 2013,” Ms Stubbings said.

But the fact that things had dragged on since 2003 did not impress counsel assisting Albert Dinelli.

“The process took 10 years. That’s not good enough is it,” he asked?

“My view is that the remediation process did take too long,” Ms Stubbings said.

“We hadn’t done anything like that before. It took us longer because we were learning … We certainly learnt a lot … and it has formed the foundations of future remediations that we have done.”

It took years for the ANZ to work out the full liability for remediating the breaches. In the years up to 2013 the bank had paid out “between $5 and $6 million”, Ms Stubbings said.

By September 2010 it had made provisions for only $23 million in payments and then estimated only 1000 customers were affected.

Ms Stubbings agreed that the bank should have identified the systemic nature of the issues earlier.

Mr Donelli characterised ANZ’s initial approach to right wrongs only as customers reported them as a “bandaid solution”.

“I’m not sure I’d say bandaid. But they’re certainly suggesting we should be looking at system fixes … rather than exception reporting or manual fixes,” Ms Stubbings replied.

Holders of Breakfree accounts, who totalled 93,000, got the biggest part of the compensation, at $48.3 million. Offset account holders were paid $21.3 million in recompense.

An ANZ review found risks that the bank had “focused on manual and detective solutions” to the problem rather than “system-based solutions”.

In December 2016 it emerged that further customers had not received interest rate discounts on mortgages because the solutions applied missed internal account changes by current bank customers. The commission adjourned before it was told how many customers were involved and how much money remediation would cost.

Earlier on Tuesday afternoon, the commission heard that customers who were placed in hardship as a result of pre-approved overdraft loans sent out by letter were not communicated with as the bank found it too hard to determine exactly who they were. Some may have been aided by the bank on hardship grounds, however.